What is Bookkeeping

Bookkeeping is the process of recording financial transactions. It tracks every dollar in and out of your business. This includes sales, purchases, payments, and receipts.

Accurate bookkeeping provides a clear picture of your financial health, helps with budgeting, and is essential for tax compliance.

Traditional Bookkeeping

What It Is

Traditional bookkeeping is a record-keeping system built around human judgment and manual ownership of financial data. Its primary purpose is to produce accurate books for compliance, tax filing, and basic financial reporting, not to operate in real time or proactively surface insights.

At a conceptual level, traditional bookkeeping assumes that:

-

People are the system: The reliability of the books depends more on the bookkeeper (or business owner) than on the tools they use.

-

Books are maintained for reporting, not for operations: The process is optimized around getting clean records for accountants, auditors, or tax season, rather than helping you make decisions day to day.

-

Accuracy is achieved through review, not automation: Mistakes are expected, and the model relies on reconciliation, cleanup, and correction as a normal part of the workflow.

-

Work happens after the fact: Transactions are typically organized once they have already occurred, rather than being processed continuously as they happen.

In essence, traditional bookkeeping treats financial records as something you maintain and periodically tidy up, rather than something that stays structured and updated automatically in the background.

How It Works

Traditional bookkeeping centers on human-led processes, even when software is used. In practice, this usually falls into three common setups:

-

Manual records or spreadsheets.

Some owners track income and expenses in physical ledgers or tools like Google Sheets or Excel. Every transaction must be copied from bank statements or receipts, labeled, and placed into the right category. The system only works as well as the person maintaining it. -

Rules-based accounting software.

Many businesses use tools like QuickBooks, Xero, or Wave. These platforms can import bank feeds and apply basic rules, but they still rely heavily on human setup and oversight. Someone must define categories, review matches, resolve conflicts, and fix misclassifications. -

Periodic cleanup by a bookkeeper or accountant.

Because records often get messy, many businesses let transactions pile up and then hire a professional monthly, quarterly, or at tax time to “clean the books.” This usually involves chasing missing receipts, reclassifying expenses, and reconciling accounts after the fact.

Across all three versions, the core pattern is the same: bookkeeping is reactive, manual, and review-heavy, with accuracy depending largely on human diligence.

AI Bookkeeping

What It Is

AI bookkeeping is a new generation of fintech bookkeeping that applies recent advances in machine learning to routine financial operations. Instead of relying primarily on human data entry or rigid accounting rules, it uses data-driven models to interpret transaction patterns, predict classifications, and standardize messy financial data at scale.

In the context of recent developments in AI and fintech operations:

-

From rigid rules to adaptive interpretation in back-office finance.

Traditional accounting tools depend on manually defined categories and logic that often break in messy real-world data. Over the past few years, AI has moved deeper into operational finance — including expense classification, receipt processing, and reconciliation — allowing systems to learn from historical transactions and handle inconsistent merchant names, mixed expenses, and edge cases more flexibly. -

Human-in-the-loop by design.

Humans remain essential not just to resolve edge cases and judgment calls, but also to improve the system over time. Corrections and feedback act as training signals that help the AI refine its categorization and decision-making through reinforcement learning.

In short, AI bookkeeping reflects a shift from manual, rule-heavy tools toward data-driven systems that learn and assist, making everyday bookkeeping faster and more consistent while keeping humans in control of final judgments.

How It Works

AI automated bookkeeping is built around data integration, machine learning, and workflow automation rather than manual data entry.

In practice, most modern systems operate in four layers:

-

Automatic data ingestion.

AI bookkeeping platforms connect directly to bank accounts, credit cards, and payment processors (e.g., Stripe, PayPal, Shopify). Transactions are pulled in continuously rather than in batches, creating a near real-time financial record without manual uploads or CSV imports. -

Intelligent categorization.

Instead of relying solely on rigid rules (as in traditional software), AI models analyze transaction patterns, merchant names, historical behavior, and contextual signals to assign categories (e.g., marketing, cost of goods sold, travel, software). Over time, the system learns from corrections and improves its accuracy. -

Automated reconciliation and anomaly detection.

AI tools match transactions across sources (bank feeds, receipts, invoices, payment platforms), flag discrepancies, and highlight unusual activity such as duplicate charges, missing receipts, or outlier expenses that warrant review. -

Continuous reporting and tax readiness.

Rather than producing reports only at month-end or tax season, AI platforms can generate up-to-date financial statements, cash flow views, and tax-relevant categorizations on demand. Some tools also surface insights such as recurring spend, margin trends, or potential write-offs.

Platforms like Fyno are typically designed with non-accountants in mind, emphasizing plain-language dashboards, smart suggestions, and minimal setup compared to traditional accounting software.

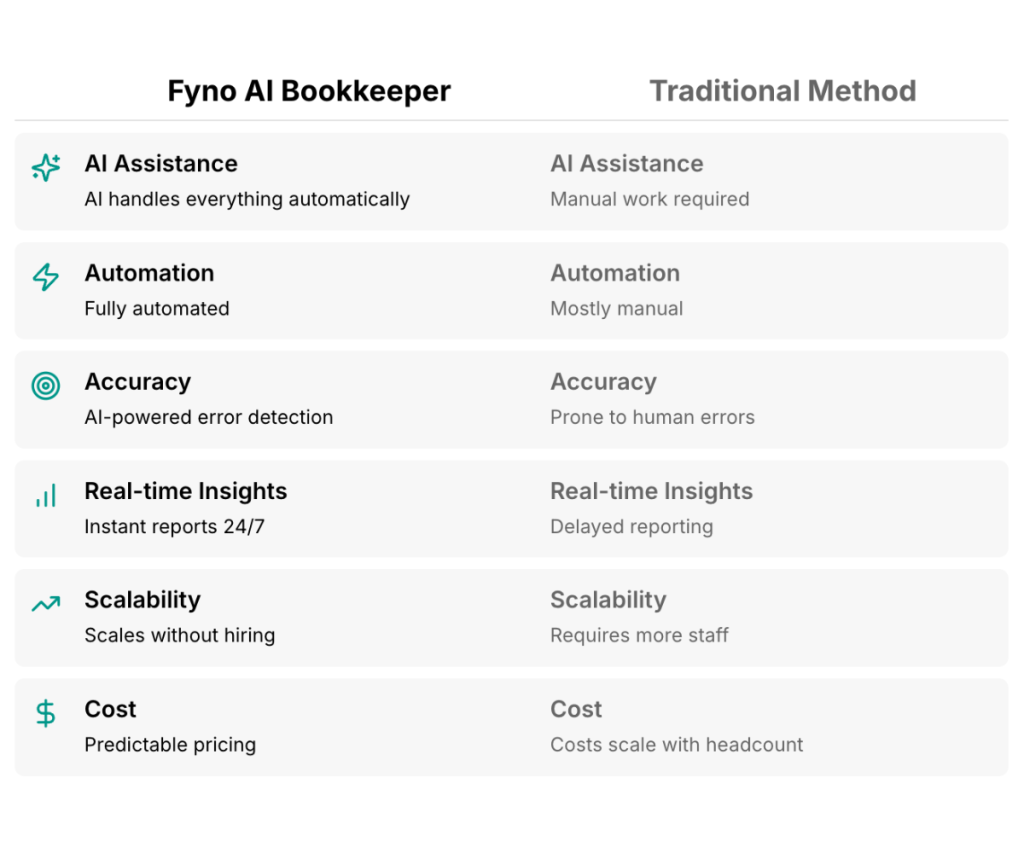

Tradeoff Evaluation

Cost: Upfront vs. Total Cost

Traditional Bookkeeping

Traditional bookkeeping often looks inexpensive at first, especially when using spreadsheets or low-cost tools, but the true economic cost quickly grows once labor and service fees are factored in:

-

Labor costs dominate traditional bookkeeping. Manual processes require significant time from business owners or bookkeepers. In the U.S., automating routine tasks like expense tracking can save over 12 hours per employee per year, underscoring the hidden labor burden of doing this work manually. (use.expensify.com)

-

Professional bookkeeping services are not cheap. For many U.S. freelancers and small businesses, outsourcing traditional bookkeeping can cost roughly $249–$299 per month, or roughly $3,000–$3,600 per year. These costs are recurring and scale with complexity. (ecombalance.com)

-

Premium accounting software carries a high price tag. At the top end, full-featured accounting suites like the high-tier QuickBooks plan cost about $275 per month, or roughly $3,300 per year, even before factoring labor and cleanup costs. (nerdwallet.com)

-

Opportunity cost isn’t free. Time spent on data entry, reconciliation, and cleanup is time not spent on revenue-generating or strategic work — a real economic cost that rarely appears in spreadsheets but affects business growth.

Bottom line: While traditional bookkeeping can appear cheaper upfront, total economic cost rises quickly once labor, professional fees, and software expenses are included.

AI Bookkeeping

AI bookkeeping tools usually involve subscription costs and implementation, but they often deliver significant savings over time by reducing manual work and associated labor costs:

-

Time savings translate to labor cost savings. Research shows that U.S. small businesses can save at least 40 % of bookkeeping time by using AI bookkeeping tools, dramatically lowering the hours that owners or staff must spend on routine tasks.

-

Fewer costly errors and rework. Because AI systems automate categorization and reconciliation, they often reduce the need for expensive cleanup later in the year, though precise cost-savings percentages weren’t disclosed in the most recent data.

-

Predictable subscription costs. AI bookkeeping tools typically use monthly or annual subscriptions instead of large upfront licenses or unpredictable service costs, making overall costs more transparent and easier to budget.

Bottom line: AI bookkeeping generally has a higher upfront software cost than spreadsheets alone, but the total cost of ownership tends to be lower over time thanks to significant time savings, reduced labor input, and fewer error-related costs.

Time: Manual Effort vs Ongoing Automation

Traditional Bookkeeping

For many small businesses, bookkeeping isn’t a once-in-a-while task, it’s a recurring time burden that never really goes away:

- Bookkeeping and admin work.

According to a 2025 Clockify study, small business owners and freelancers spend roughly 6 hours per week on bookkeeping and other administrative tasks — about 312 hours per year. (Clockify) - Tax preparation burden.

Beyond weekly bookkeeping, preparing for taxes adds more overhead. A 2025 FreshBooks report notes that small business owners spend about 10 hours per year on tax preparation alone. (FreshBooks) - Work piles up over time.

Because traditional bookkeeping is generally done in batches (at month-end, quarterly, or before taxes), the work tends to accumulate between sessions, creating stressful crunch periods that take longer than anticipated. - Time increases with business growth.

As transaction volume rises — more sales, expenses, accounts, and receipts — the sheer amount of data to record and reconcile increases, meaning owners or bookkeepers must spend even more time each week.

AI Bookkeeping

AI bookkeeping tools take a fundamentally different approach to time:

- Background processing reduces manual effort.

Instead of waiting for transactions to pile up, AI systems continuously ingest and categorize data, which shifts bookkeeping from a heavy batch task to a quick periodic review. - Routine work drops dramatically.

With AI handling data import, categorization, and matching, business owners and bookkeepers are left mainly with exception review and judgment calls, which take far less time than end-to-end manual bookkeeping. - Scales with volume without adding hours.

Higher transaction volume does not translate into proportionally more human hours — because the system handles the bulk of the repetitive work.

Tradeoff takeaway:

Traditional bookkeeping demands more ongoing human time, while AI bookkeeping saves time and smooths your workload.

Accuracy: Human Judgment vs System Consistency

Traditional Bookkeeping

- Accuracy can be very high when a skilled, detail-oriented bookkeeper is actively managing the books.

- Even then, outcomes depend heavily on human consistency, discipline, and available time.

- Transactions can be missed, especially when receipts are incomplete or bank feeds are not reviewed regularly.

- Expenses are frequently misclassified, particularly for mixed business-personal spending or unusual vendors.

- Simple data-entry mistakes — typos, duplicate entries, or misdated transactions — are common and can snowball into bigger reconciliation problems later.

AI Bookkeeping

- AI systems are far more consistent at handling routine, high-volume transactions.

- They materially reduce basic human errors: 2024 analyses found that AI bookkeeping tools cut manual errors by up to 90%, leaving roughly a 10% residual error rate. (articsledge.com)

- Automated matching across bank feeds, receipts, and payments makes duplicate entries and completely missed transactions much less likely than in manual systems.

- However, AI still struggles in predictable edge cases — such as mixed personal and business expenses, unusual one-off transactions, or nuanced tax rules.

- The same research shows AI systems still exhibit misclassification and tax-rule misunderstanding rates of about 10–15%, which makes human oversight essential for accuracy and compliance. (accountancyage.com)

- In practice, the best setup is “human-in-the-loop”: AI handles routine categorization, while a person reviews exceptions and trains the system over time.

Tradeoff takeaway:

AI delivers stronger, more consistent accuracy for routine transactions, while human judgment remains necessary for edge cases, complex classifications, and tax-sensitive decisions.

Scalability: Fragile vs Built to Grow

Traditional Bookkeeping

-

Manual systems often become difficult to manage as your business scales.

-

Growth usually means more of your time, hiring a bookkeeper, or upgrading your software.

-

Many businesses eventually outgrow simple spreadsheets or basic tools.

AI Automated Bookkeeping

-

AI systems are designed to handle growth from the start.

-

More transactions simply mean more data for the system to learn from.

-

This works especially well for e-commerce businesses, freelancers with multiple income streams, and fast-growing companies.

Tradeoff takeaway:

Traditional bookkeeping gets harder as you grow, while AI bookkeeping gets more effective.

Insights: Record-Keeping vs Decision-Making

Traditional Bookkeeping

-

Traditional bookkeeping is mostly backward-looking.

-

Reports are often delayed until after the month or quarter ends.

-

Meaningful insights usually require extra analysis, custom spreadsheets, or accountant interpretation.

AI Automated Bookkeeping

-

Many AI tools provide real-time dashboards and reports.

-

You can see where your money is going at any moment.

-

This makes it easier to track cash flow, spending patterns, and profitability.

-

Some platforms even surface proactive insights about your finances.

Tradeoff takeaway:

Traditional bookkeeping helps you record your finances, while AI bookkeeping helps you actively use them.

Choose Your Best Method

Decision Factors

To find your optimal solution, consider your unique business profile. This “Bookkeeping Fit Finder” helps map your needs:

- Business Complexity:

- Simple (Few transactions): Think solo freelancer with minimal expenses.

- Moderate (Multiple streams): A small e-commerce store with varied product lines.

- High (Inventory, payroll): A service-based business with contractors or physical goods.

- Growth Trajectory:

- Stable/Static: Your business maintains consistent transaction volume.

- Growing Rapidly: You expect significant increases in sales and expenses.

- Budget & Time Investment:

- Low: You have very limited funds for software or external help.

- Moderate: You can afford a monthly subscription for AI bookkeeping services.

- High: You have the capacity for dedicated staff or premium software.

- Accounting Knowledge:

- None: You need a system that handles most details for you.

- Basic: You understand core financial concepts.

- Proficient: You’re comfortable with advanced accounting principles.

Practical Scenarios

- For the New Solopreneur: If you have just a handful of transactions each month and a very tight budget, manual tracking on a basic spreadsheet might suffice for now. But be ready to switch quickly as you grow.

- For the Growing Businesses: With increasing sales and varied expenses, an AI bookkeeping software is almost essential. It handles transaction volume, integrates with payment platforms, and provides actionable insights.

- For the Established Service Business: An AI bookkeeping software for small business allows you to automate payroll, client invoicing, and expense tracking, freeing up time for client work or strategic planning. You can also leverage its reporting for tax preparation.

Ask yourself: “How much time am I willing to spend on data entry each week?” and “How critical is real-time financial data for my decision-making?” Your answers will guide your choice.

FAQs

Q: Can I still use Google Sheets for bookkeeping?

Google Sheets works for very simple, low-volume transactions, but quickly becomes inefficient and error-prone as your business grows, lacking automation and advanced reporting.

Q: How much does AI bookkeeping cost?

AI bookkeeping software costs vary but are generally a monthly subscription, often significantly less than hiring a human bookkeeper, especially for routine tasks.

Q: Is AI bookkeeping secure for my financial data?

Reputable AI bookkeeping platforms employ advanced encryption and security protocols, often exceeding the security of manual, paper-based systems.

Q: Do I still need an accountant with AI bookkeeping?

AI bookkeeping automates daily tasks, freeing your accountant to focus on strategic advice, tax planning, and complex financial analysis, rather than data entry.

Q: What if my business needs change over time?

AI bookkeeping solutions are typically scalable, adapting as your transaction volume or business complexity grows, offering flexibility that manual systems often lack.

Q: How long does it take to switch to AI bookkeeping?

The transition time varies by AI bookkeeping software and business size, but most platforms offer streamlined setup processes and data import tools to make switching relatively quick and painless.

Ultimately, choosing between AI-automated and manual bookkeeping depends on your business’s unique stage, complexity, and resources. For small business owners and solopreneurs looking to save costs on bookkeepers without needing an accounting degree, an AI-automated solution like Fyno offers an easy, efficient, and accurate path forward.

Leave a Reply